Table Of Content

The lengthy 30-year term allows you to spread out your payments over a long period of time, meaning you can keep your monthly payments lower and more manageable. The trade-off is that you'll have a higher rate than you would with shorter terms or adjustable rates. The exact lock period may vary, but typically you can lock in a mortgage rate for 30 to 60 days. If the rate lock expires, you’re no longer guaranteed the locked-in rate unless the lender agrees to extend it.

Fed Holds Rates Steady, Again: What This Means for Mortgage Rates in 2024

This three-page standardized document will show you the loan’s interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years. Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesn’t process the loan before the rate lock expires, you’ll need to negotiate a lock extension or accept the current market rate at the time. When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate.

NerdWallet’s mortgage rate insight

Mortgage Rates Today: April 23, 2024—Rates Remain Fairly Steady - Forbes

Mortgage Rates Today: April 23, 2024—Rates Remain Fairly Steady.

Posted: Tue, 23 Apr 2024 08:30:17 GMT [source]

With a mortgage refinance, you replace your current home loan with a new one. Much like when you bought your home, you’ll have to meet the lender’s refinance requirements and go through the application and closing process. A record of paying your mortgage on time isn't enough; you'll need to be sure you can qualify for the new loan. A rate lock will prevent the interest rate you've been offered from rising before your loan closes. Some lenders also offer a “float down” option, which will protect you if rates take a downward turn.

Mortgage predictions for 2024

It’s possible for your initial rate lock to be voided if things like your credit score, loan amount, debt-to-income ratio or appraisal value change during the lock period. The rates and monthly payments shown are based on a loan amount of $464,000 and a down payment of at least 25%. Learn more about how these rates, APRs and monthly payments are calculated. Plus, see a conforming fixed-rate estimated monthly payment and APR example.

Federal Housing Administration (FHA) loans

Also, you need to keep in mind the posted note rate, or the rate you locked in with your lender that is used to calculate your monthly principal and interest rate. Check that it does not include any upfront fees or points that could be charged. So looking at the APR, or annual percentage rate, provides a better all-in representation of what you may pay. Remember that you may be able to obtain a lower rate but by paying a higher percent of points.

What is a lender credit?

Use our free mortgage calculator to see how today's interest rates will affect your monthly payments. In terms of factors you can alter, your credit score is front and center for influencing the refinance rate you will receive. Check your credit report before refinancing to make sure there aren’t any errors. Build your credit score before refinancing by paying your bills on time and keeping credit utilization low. NerdWallet’s comparison tool can help you find current refinance rates for your mortgage.

Mortgage refinance news

Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. Before joining Bankrate in 2020, I spent more than 20 years writing about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. I’ve had a front-row seat for two housing booms and a housing bust. I’ve twice won gold awards from the National Association of Real Estate Editors, and since 2017 I’ve served on the nonprofit’s board of directors. On Saturday, April 27, 2024, the national average 30-year fixed mortgage APR is 7.37%. The average 30-year fixed refinance APR is 7.37%, according to Bankrate's latest survey of the nation's largest mortgage lenders.

How to compare current mortgage rates between lenders

The average APR on the 30-year fixed-rate jumbo mortgage refinance is 7.72%. The monthly payment shown is made up of principal and interest. It does not include amounts for taxes and insurance premiums. The monthly payment obligation will be greater if taxes and insurance are included. CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them.

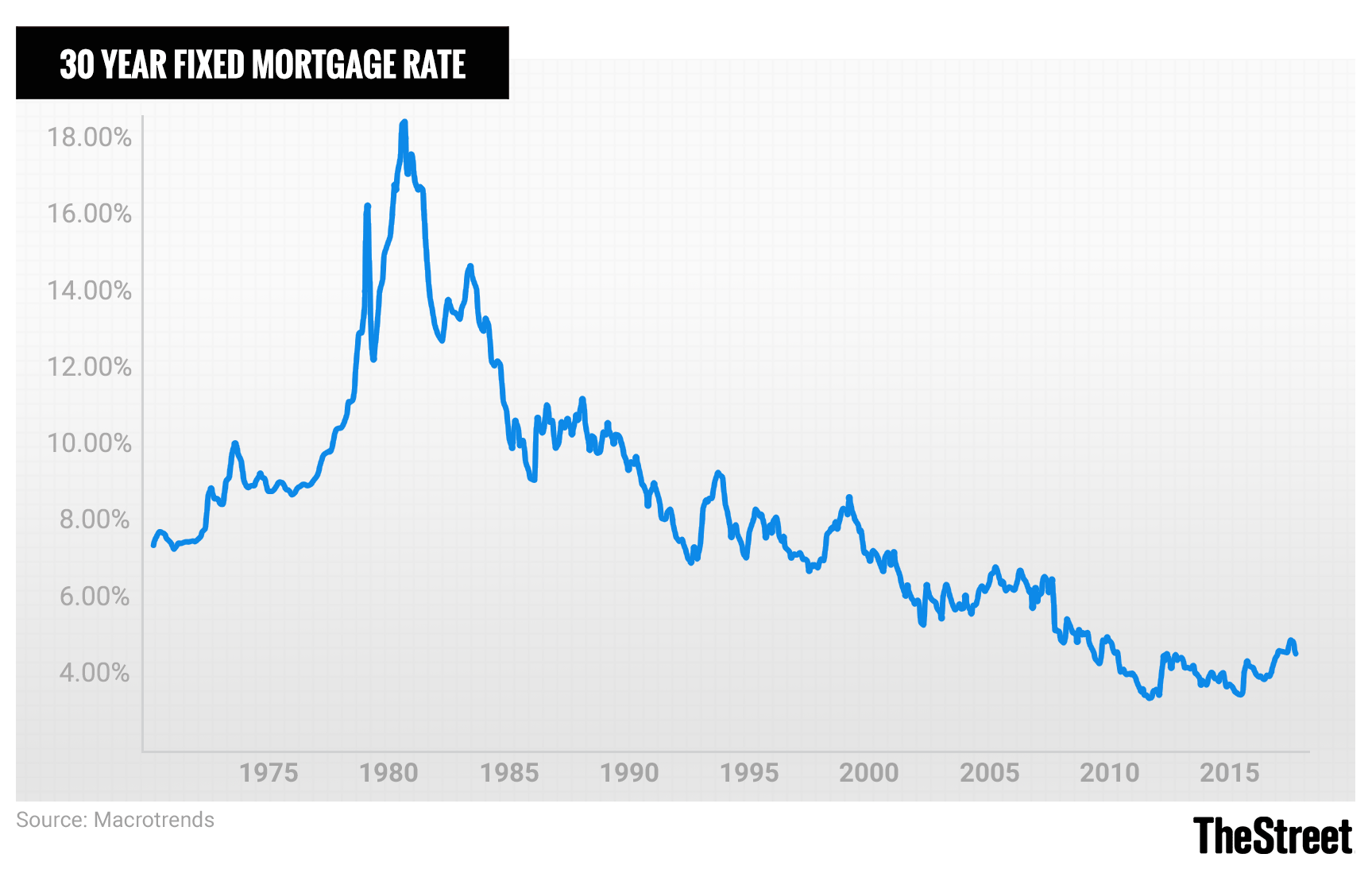

Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board's response to COVID-19 in efforts to keep financial markets open.

You’ll be in good shape if you can nail down an account offering a rate close to 4.97%. Today’s highest rate on a standard savings account with a $2,500 minimum deposit requirement is 5.84%, according to data from Curinos. If you score a basic savings account with a rate in that range, you’ve found a good deal. Caroline Basile is Forbes Advisor’s student loans and mortgages deputy editor. With experience in both the mortgage industry and as a journalist, she was previously an editor with HousingWire, where she produced daily news and feature stories. She holds a degree in journalism from the University of North Texas.

Payment information does not include applicable taxes and insurance. Zillow Group Marketplace, Inc. does not make loans and this is not a commitment to lend. A 30-year fixed-rate mortgage has a 30-year term with a fixed interest rate and monthly principal and interest payments that stay the same for the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that will remain the same for an initial fixed number of years, and then adjusts periodically for the remainder of the term.

The current national mortgage rates forecast indicates that rates are likely to remain high compared to recent years, but could trend closer to 6% if inflation continues to decrease in 2024. This week, 30-year mortgage rates went up by 0.07% and 15-year rates increased by 0.05%. Keep in mind, the 30-year mortgage may have a higher interest rate than the 15-year mortgage, meaning you'll pay more interest over time since you're likely making payments over a longer period of time. Additionally, spreading the principal payments over 30 years means you'll build equity at a slower pace than with a shorter term loan. The current average interest rate on a 30-year, fixed-rate jumbo mortgage is 7.61%— 0.08 percentage point up from last week. The 30-year jumbo mortgage rate had a 52-week APR low of 5.00% and a 52-week high of 10.50%.

But you could pay more after that period, depending on how the rate adjusts annually. If you plan to sell or refinance your house within five years, an ARM could be a good option. The average 30-year fixed-refinance rate is 7.30 percent, up 23 basis points over the last seven days. A month ago, the average rate on a 30-year fixed refinance was lower at 6.91 percent.

No comments:

Post a Comment