Table Of Content

Nonetheless, experts foresee an inevitable downward trend, though probably not in the immediate future. For those hoping to refinance, mortgage rates are not cooperating. If you’re considering refinancing to lower your monthly payment, keep in mind that not all options yield less interest over the life of the loan. Average 15-year mortgage rates inched up to 6.44% this week, according to Freddie Mac data. The 30-year fixed-rate mortgage is the most common type of home loan. With this type of mortgage, you'll pay back what you borrowed over 30 years, and your interest rate won't change for the life of the loan.

How to choose the best mortgage lender for you

With these loans, you don’t have to pay the closing costs upfront, but you will pay them one way or another. Lenders cover the cost of the refinancing by charging a higher interest rate or rolling the fees into the total loan amount. Increasing your loan amount bumps up the amount you'll pay monthly as well as over the life of the loan. To ensure you’re getting the best possible rate, request quotes from multiple refinance lenders. Compare the interest rate, annual percentage rate (APR), estimated closing costs and other fees included on each Loan Estimate.

Pros and cons of refinancing

Make sure you compare the APR between lenders, not just the rate. The APR is the all-in total of your mortgage costs, which can vary by lender, and will include your closing costs if rolled into your loan. But just because lenders offer a certain rate doesn’t mean you’ll necessarily qualify for it. Often lenders will publish their lowest rate available, but those rates are reserved for borrowers who tick several boxes, like holding a high credit score and a low loan-to-value ratio. “Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates,” Kushi said.

Today's national 30-year mortgage interest rate trends

Mortgage Interest Rates Today, April 22, 2024 The Still-Hot Economy is Keeping Rates High - Business Insider

Mortgage Interest Rates Today, April 22, 2024 The Still-Hot Economy is Keeping Rates High.

Posted: Mon, 22 Apr 2024 10:00:00 GMT [source]

Plus, see a jumbo estimated monthly payment and APR example. The rates and monthly payments shown are based on a loan amount of $270,072 and no down payment. The rates and monthly payments shown are based on a loan amount of $270,019 and a down payment of at least 3.5%. The term is the amount of time you have to pay back the loan.

The most common terms are the 30-year fixed-rate mortgage, the 15-year fixed, and the 5-year adjustable-rate mortgage. Mortgage points represent a percentage of an underlying loan amount—one point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when they’re initially offered the mortgage. There are many ways to search for the best mortgage lenders, including through your own bank, a mortgage broker or shopping online. To help you with your search, here are Forbes Advisor’s picks of the best mortgage lenders across the country. The advantage of going with a broker is you do less of the work and you’ll also get the benefit of their lender knowledge.

Certain types of savings accounts—such as relationship-based accounts and accounts designed for youths, seniors and students—are not considered in the calculation. It can be tricky to time any market, and mortgage rates are no exception. If conditions are choppy, and interest rates are likely to rise, it may be smart to lock in a rate that works with your budget and seems fair to you. Whether or not 2024 will be a good time to refinance depends on several factors, including if the Fed cuts interest rates this year and by how much. The mortgage rate you got when you financed your home is another major factor. Despite mortgage rates remaining stubbornly high, most housing market experts expect them to recede over 2024, assuming the Federal Reserve acts on its signaled interest rate cuts.

How We Make Money

The APR may be increased or decreased after the closing date for adjustable-rate mortgages (ARM) loans. A 30-year fixed-rate mortgage is by far the most popular home loan type, and for good reason. This home loan has relatively low monthly payments that stay the same over the 30-year period, compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage.

When should you refinance your mortgage?

It's still early in the year, and there will be many inflation reports released between now and September, when investors believe the Fed might finally start cutting rates. But inflation is currently expected to decelerate this year, so we could still see mortgage rates fall this year. New inflation data has some thinking the Federal Reserve might not cut rates at all this year, which would keep mortgage rates elevated for longer than expected.

Pros and cons of a 30-year mortgage

Mortgage Refinance Rates Today: April 24, 2024—Rates Hold Steady - Forbes

Mortgage Refinance Rates Today: April 24, 2024—Rates Hold Steady.

Posted: Wed, 24 Apr 2024 08:01:07 GMT [source]

Paying attention to your mortgage rate could help you shave thousands of dollars -- or even tens of thousands -- off the total cost of your loan. This is a situation where your efforts could have a big payoff. Here's what you need to know about getting the best current mortgage rate.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

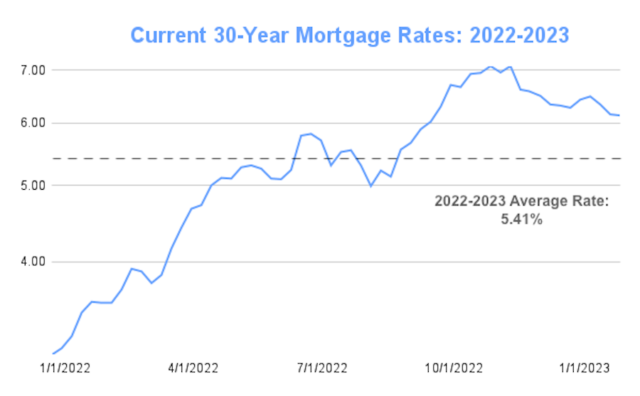

Over 40% of U.S. mortgages originated in 2020 and 2021, when interest rates were at record lows. There were also some 14 million mortgage refinances during the same time. If you were lucky enough to secure a mortgage during that time, then 2024 is likely not the ideal time to refinance.

For example, they might be able to match you with a lender who’s suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee. Currently, the average 30-year, fixed-rate mortgage is 7.17% as of April 25, according to Freddie Mac.

Teaser rates are often obtained through an adjustable-rate mortgage (ARM) loan, that have 3-, 5- or 7-year options. A 15-year, fixed-rate mortgage with today’s interest rate of 6.90% will cost $893 per month in principal and interest on a $100,000 mortgage (not including taxes and insurance). In this scenario, borrowers would pay approximately $60,734 in total interest. In total interest, you’d pay $155,400 over the life of the loan. Borrowers can get preapproved for a mortgage by meeting the lender’s minimum qualifications for the type of home loan you’re interested in. For example, a conventional mortgage usually has higher credit score and down payment requirements than government loans, such as Federal Housing Administration (FHA) and Veterans Affairs (VA) mortgages.

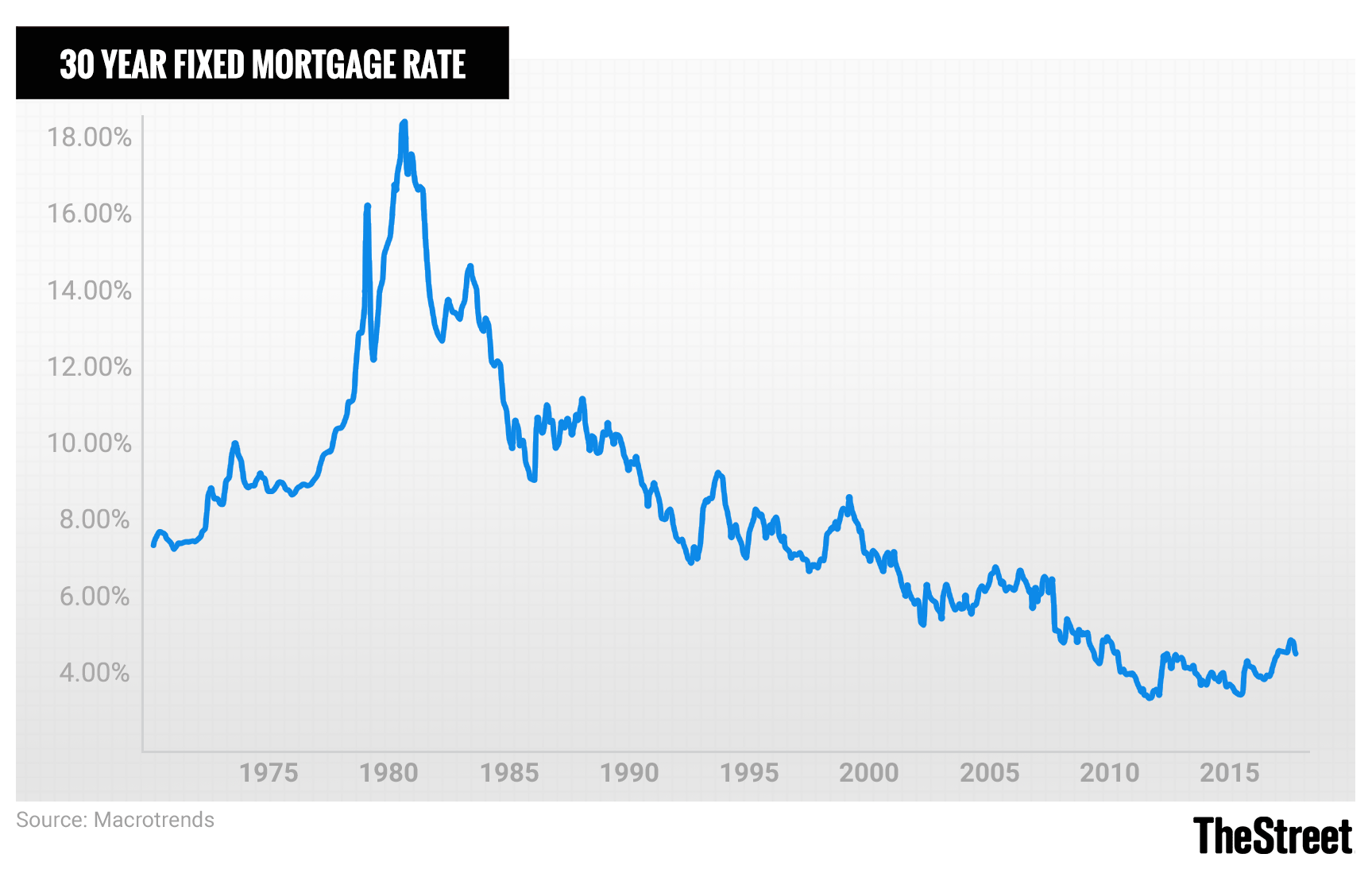

When she’s not working on finance-related content, Caroline enjoys baseball, traveling and going to concerts. Her work has been published or syndicated on Forbes Advisor, SoFi, MSN and Nasdaq, among other media outlets. The average mortgage rate for a 30-year fixed is 7.12%, nearly double its 3.22% level in early 2022. Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower. The Federal Reserve has increased the federal funds rate dramatically to try to slow economic growth and get inflation under control.

However, extending the rate lock period up to 90 or 120 days is possible, depending on your lender, but additional costs may apply. If you come from a qualifying military background, VA loans can be your best option. First, you don’t need to make a down payment in most situations.